Markets live updates: Wall St crumbles on fresh threats to Fed’s independence, ASX opens lower

Market snapshot

- ASX 200: -0.6% to 7,770 points (live values below)

- Australian dollar: +0.1% to 64.19 US cents

- Wall Street: Dow -2.4%, S&P 500 -2.5%, Nasdaq -2.5%

- Europe (Thursday): DAX -0.5%, FTSE flat, Eurostoxx -0.3%

- Spot gold: -0.2% to $US3,420/ounce

- Brent crude: -2.1% to US$66.51/barrel

- Iron ore (Thursday): +2.2% to $US99.60/tonne

- Bitcoin: +0.2% to $US87,522

Prices current around 10:20am AEST

Live updates on the major ASX indices:

James Hardie shares down more than 2 per cent

ASX falls modestly in early trade

The Australian share market has opened lower, but the falls are much more modest than seen on Wall Street.

The ASX 200 and All Ords are both off 0.6 per cent at the moment.

Macquarie pockets $2.8 billion in sale of US and European investment business

Macquarie Group’s asset management business (MAM) has sold its North American and European public investments business for $2.8 billion.

Macquarie struck the deal with Japanese financial services giant Nomura to sell all the North American and European focused public investments business comprising equities, fixed income and multi-asset strategies, with about $A285 billion of assets under management.

The business is based in Philadelphia and has more than 700 employees.

MAM will retain its public investments business in Macquarie’s home market of Australia.

Under the deal, Nomura will distribute MAM products to US clients and will provide seed capital for a range of MAM Alternative funds tailored for the US market.

Macquarie said the transaction built on the recent Nomura Macquarie Private Infrastructure Fund joint venture launched in Japan earlier this year.

“As a result of the transaction, MAM will be a more focused, leading, global private markets alternatives business serving the fast-growing Institutional, Insurance and Wealth markets, with a scaled full-service asset manager in Australia,” Macquarie said in a statement this morning.

NZ opens 0.7% lower

Just a quick glance across the ditch to see how New Zealand’s stock market is going after Wall Street’s overnight capitulation.

The NZ50 was broadly down, trading 0.7% lower at 9:30am AEST.

China’s trade war advantage over Donald Trump

The insults and assaults may be global but, increasingly, Donald Trump’s war against everyone is being whittled down to a fight for dominance between America and its main rival, China.

It is a war neither side can win, chief business correspondent Ian Verrender writes.

It’s more a question as to the amount of pain either country can endure, and which will emerge with the least damage.

China’s control of the critical minerals, particularly rare earths, America needs for everything from its Air Force jets to powering the AI boom, put the US in a tough spot.

Read more here:

James Hardie shares on watch after investor backlash

Shares in building materials firm James Hardie will be in focus when Australian stocks return to trade after the long weekend.

Late Thursday, it came to light that a group of investors had written to the Australian Stock Exchange, calling for a review of listing rules.

It followed James Hardie’s $13.6 billion deal to take over Wall Street-listed AZEK, creating a combined company.

The investors, including AustralianSuper and UniSuper, and institutional investors Schroder Investment and Fidelity Australia, wrote to the ASX saying the move would significantly dilute interests of existing shareholders and “irreversibly change their rights” without any vote.

They argued for shareholder approval to be made a condition for share issuance above a certain threshold, as well as for modifications to listings, according to Reuters, which reviewed a copy of the letter.

“A shift of primary listing would result in a permanent alteration of the rights of James Hardie shareholders, as there are clear differences between the listing rules of the ASX and the NYSE which are detrimental to James Hardie shareholders,” the investors said.

“We consider that this transaction creates an immediate need for the ASX to reconsider the exercise of ASX discretions in these types of circumstances, and refresh ASX guidance and the ASX listing Rules.”

Reporting with Reuters

This week: Tesla and Alphabet results, global manufacturing in the spotlight

Australia:

Wed: Purchasing managers’ index (PMI), Resmed Q3 earnings, Newmont Q1 earnings

International:

Wed: US — PMI (Apr), New home sales

Thu: US — Durable goods orders (Mar), Existing home sales (Mar)

It’s a fairly quiet week in the diary, with nothing set down likely to trump (so to speak) unscheduled and unpredictable events that are currently cooking the markets.

Quarterly earnings reports from Tesla on Tuesday and Alphabet (a.k.a Google) on Wednesday will give a clearer picture of how two of the pillars of the so-called “Magnificent Seven” tech stocks are faring in the trade war.

For local investors, the dual-listed Resmed and Newmont will also release quarterly results in the US.

The only local piece of data to be published is S&P Global’s Purchasing Managers’ Index on Wednesday.

Local manufacturers have been reporting increased activity over the past few months, although the outlook — particularly among exporters — may be getting cloudier.

S&P Global will be releasing PMIs across most key economies this week which should provide an interesting take on how the world’s manufacturers and service industries are coping.

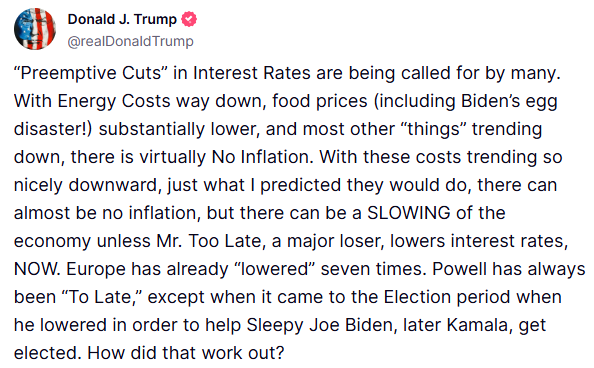

Donald Trump on Federal Reserve chair Jerome Powell

While President Trump’s social media post attacking US Federal Reserve boss Jerome Powell finally cracked the markets overnight, it’s fair to say he’s been chipping away for some time.

Here’s Mr Trump from last week.

Loading…

What’s got Donald Trump lobbing threats at US Fed chair?

US investor concerns that Donald Trump could move to oust the Federal Reserve chair, threatening the central bank’s independence, sent Wall Street tumbling overnight.

The US president ramped up his attack on Jerome Powell, taking to his social media platform to brand him as ‘Mr Too Late’ and ‘a major loser’.

It followed comments from Mr Powell last week, maintaining that the Fed would not move quickly to lower interest rates given its mandate, saying “our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem“.

In response to Mr Powell’s comments, Barrenjoey’s chief interest rate strategist Andrew Lilley said market bets for an interest rate cut in the US by July are not a sure thing.

Watch his interview with Alicia Barry on The Business on Thursday here:

Loading…

‘Sell America’ trade intensifies

The “sell America” trade is now in full flight following the White House’s renewed attacks on the US Federal Reserve, according to NAB’s Head of Market Economic Tapas Strickland.

In his morning note, Mr Strickland said while a first volley against the Fed on Thursday was largely ignored, subsequent attacks from White House economic advisor Kevin Hassett on Friday, and President Donald Trump overnight, prompted a “violent reaction” on markets.

Hassett said Trump was studying whether he was able to fire Fed Chair Powell.

“Hassett also distanced himself from his prior stance of advocating for an independent Fed during Trump 1.0,” Mr Strickland said.

“The Supreme Court is due to rule any day now on whether Trump has the authority to remove board members of two other independent agencies,” Mr Strickland noted as another reason for the market’s sudden sell-off.

“The ‘sell America’ trade was in full flight on Monday, though moves may have been exacerbated with the Easter break and Europe out.

“Whether or not President Trump is legally able and willing to move against the US Fed, the jousting underscores the loss of US exceptionalism and the very real policy risk for investors.”

Trump’s post

Here’s the post from President Trump’s Truth Social platform that helped send Wall Street into this morning’s tailspin.

Good morning

Good morning and welcome to another week on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, it could be another anxious day on the ASX after Wall Street crumbled 3% overnight.

Futures trading points to the ASX opening 0.6% higher, but that’s unlikely to be much of a guide given they last traded on Thursday.

As always, the game’s afoot, so let’s get blogging.

Loading

Market snapshot

- ASX 200 futures: +0.6% to 7,834 points

- Australian dollar: +0.6% to 64.14 US cents

- Wall Street: Dow -2.4%, S&P 500 -2.5%, Nasdaq -2.5%

- Europe (Thursday): DAX -0.5%, FTSE flat, Eurostoxx -0.3%

- Spot gold : +2.9% to $US3,424/ounce

- Brent crude: -2.1% to US$66.51/barrel

- Iron ore (Thursday): +2.2% to $US99.60/tonne

- Bitcoin: +2.5% to $US87,201

Prices current around 7:15am AEST

Wall Street crumbles on fresh threats to the Fed’s independence

The White House’s intensified attacks on US Federal Reserve chair Jerome Powell have sent Wall Street plummeting again.

The Dow (-2.4%), the S&P 500 (-2.5%) and the Nasdaq (-2.5%) all crumbled as the Trump administration switched its battleground from offshore targets to local enemies, in this case the US Federal Reserve just down the road.

President Donald Trump followed up White House economics advisor Kevin Hassett’s Good Friday musings that the administration was looking at ways of sacking Mr Powell with another stream of invective overnight.

Mr Trump tapped out a social media post saying the US was heading for an economic slowdown thanks to Mr Powell and the Fed not cutting rates.

“Unless Mr. Too Late, a major loser, lowers interest rates NOW,” Mr Trump posted on his Truth Social platform.

The fresh assault on the Fed’s independence is likely to set the tone for global markets this week.

“Countries that have an independent central bank grow faster, have lower inflation; they have better economic outcomes for their people,” Argent Capital’s Jed Ellerbroek noted after today’s rout.

“Politicians trying to influence the Fed is a really bad idea, and it’s very scary for the market.”

ASX 200 futures (+0.6%) last traded on Thursday and are unlikely to be a good guide for today’s action.

The US dollar continued its decline with the Aussie dollar now back above 64 US cents.

Gold predicably galloped ahead in Monday trade, up almost 3% to yet another record, punching through $US3,400/ounce.

Oil traders were also back at the desk on Monday and viewed positive progress in US/Iran talks as a signal to sell.

That, and increasingly gloomy takes on where the global economy is heading saw Brent crude fall to 2% to $US66.51 a barrel.