ITAT declares Rs 2.6 crore flat received for vacating land as non-taxable, ET RealEstate

MUMBAI: In what marks a second major victory for a Mumbai resident, the income tax appellate tribunal (ITAT) has ruled in his favour in a long-standing tax dispute. It held that the compensation he received in the form of a flat worth Rs 2.6 crore for vacating a portion of the land alleged to be illegally occupied by him was a non-taxable ‘capital receipt’.

The first win came when he secured a valuable flat in Orchid Enclave in south Mumbai, through a settlement with the real estate redeveloper. As he was not included in the list of tenants that was submitted to the municipal corporation and/or Mhada, he filed a legal suit against the redeveloper claiming to be a long-time lawful occupant of a portion of the land on which he had built a shed. This land was to undergo redevelopment. While the suit was pending, the builder reached a settlement with him and allotted him the flat.

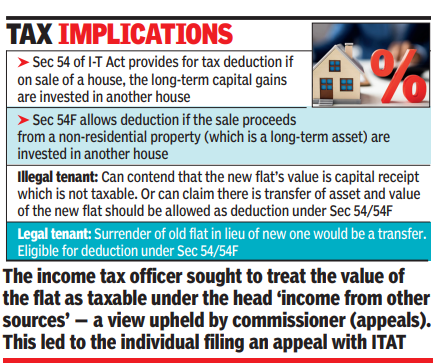

The second win was scored in the tax arena. The income tax (I-T) officer sought to treat the value of the flat as taxable under the head ‘income from other sources’—a view upheld by the commissioner (appeals). This led to the individual filing an appeal with ITAT.

The tribunal noted that the individual has created nuisance to the redeveloper and the flat was allotted to him as compensation for removing this nuisance. Relying on judicial precedent, it held the value of the flat to be a capital receipt which is not subject to tax. The tribunal directed the I-T officer to delete the addition of Rs 2.6 crore that had been made to the individual’s taxable income.

Anil Harish, advocate and partner at DM Harish & Co explained that two alternative contentions were put forward by this individual before the ITAT bench. The first was that he had been holding a capital asset (possessed a piece of land) for many years and surrendered this possession and the rights to the asset. In lieu of this, he obtained a residential house and the value of this new flat should be eligible for the deduction under Section 54F of I-T Act. The second contention was that he was given the new flat to remove the nuisance caused by his illegal occupation. This aspect was argued in detail during the ITAT hearing and was accepted by the bench.”The nuisance factor can be claimed only by a person who is an illegal occupant, not by a legal tenant who is surrendering his old flat under a redevelopment project. For legal tenants, the transaction would be a ‘transfer’. However, the value of the new flat would be allowed as a deduction under Section 54/54F of I-T Act, resulting in no taxable capital gains,” said Harish.