Retrofitting can unlock ₹1.2–1.6 lakh crore in asset value across Indian offices: CBRE, ET RealEstate

NEW DELHI: India’s ageing office stock presents a significant value creation opportunity, with strategic retrofitting capable of unlocking up to ₹1.2–1.6 lakh crore in capital value, according to a recent report by CBRE South Asia.

The report estimates that such upgrades could drive 25–40% asset value enhancement in key commercial micro-markets.

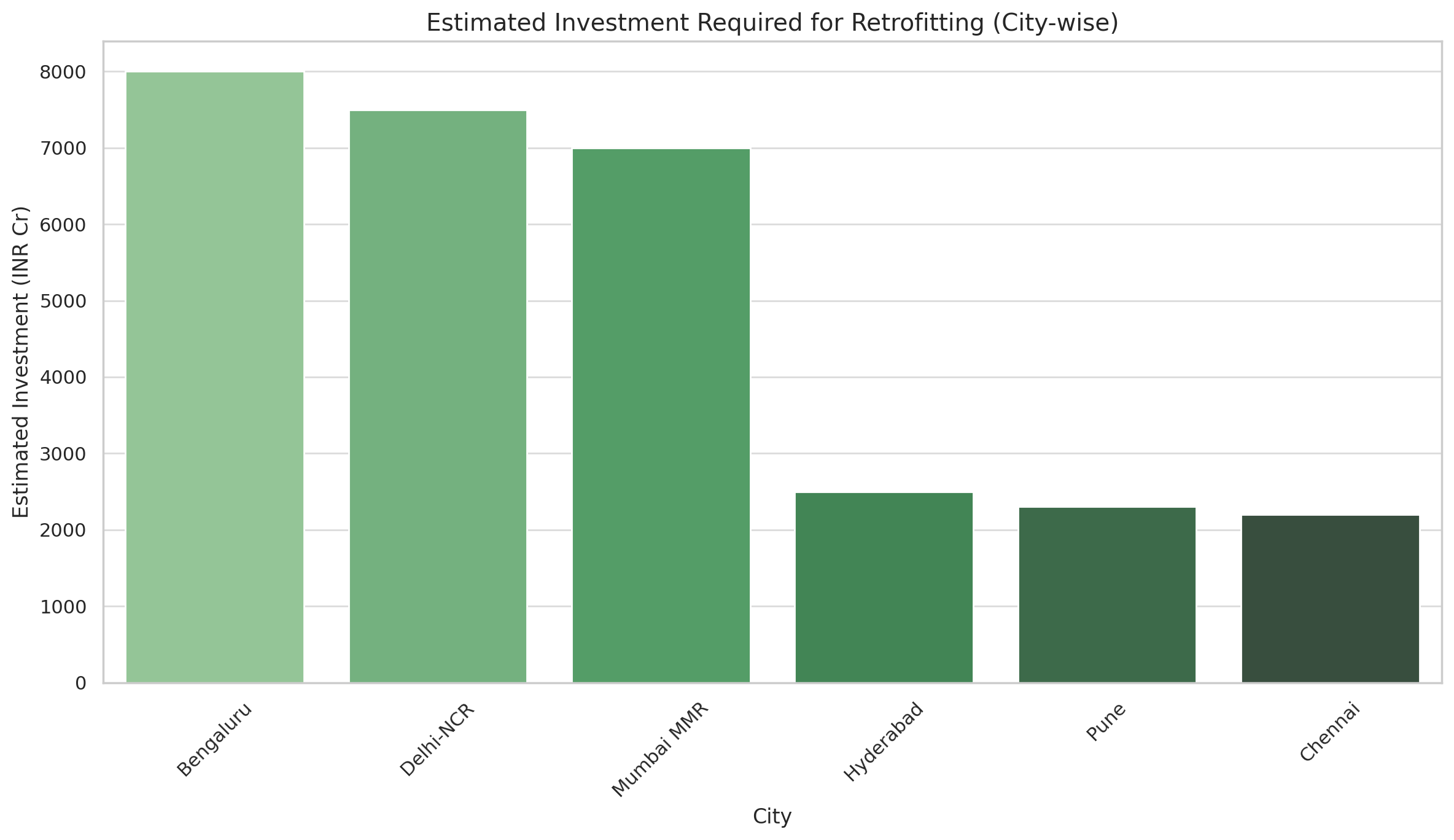

To realise this potential, the total investment required is estimated between ₹30,000–40,000 crore, depending on the scale and scope of enhancements. This includes structural upgrades, façade modernisation, HVAC optimisation, ESG compliance, and the addition of employee-centric amenities. The report adds that well-executed retrofits can offer a 3–5 year payback period, driven by improved occupancy, better lease terms, and enhanced tenant retention

CBRE estimates that close to 160–180 million sq ft of India’s office stock is over a decade old and likely in need of refurbishment or complete repositioning. “With workplace preferences changing rapidly and tenants now demanding enhanced sustainability, wellness, and smart technology integration, retrofitting offers a high-return solution for landlords and investors,” said Abhinav Joshi, head of research – CBRE India, MENA & SE Asia.

The report notes that capital value enhancement post-retrofit could reach 40% in select micro-markets, with rental appreciation potential ranging between 15–35%, depending on location, scope, and quality of upgrades

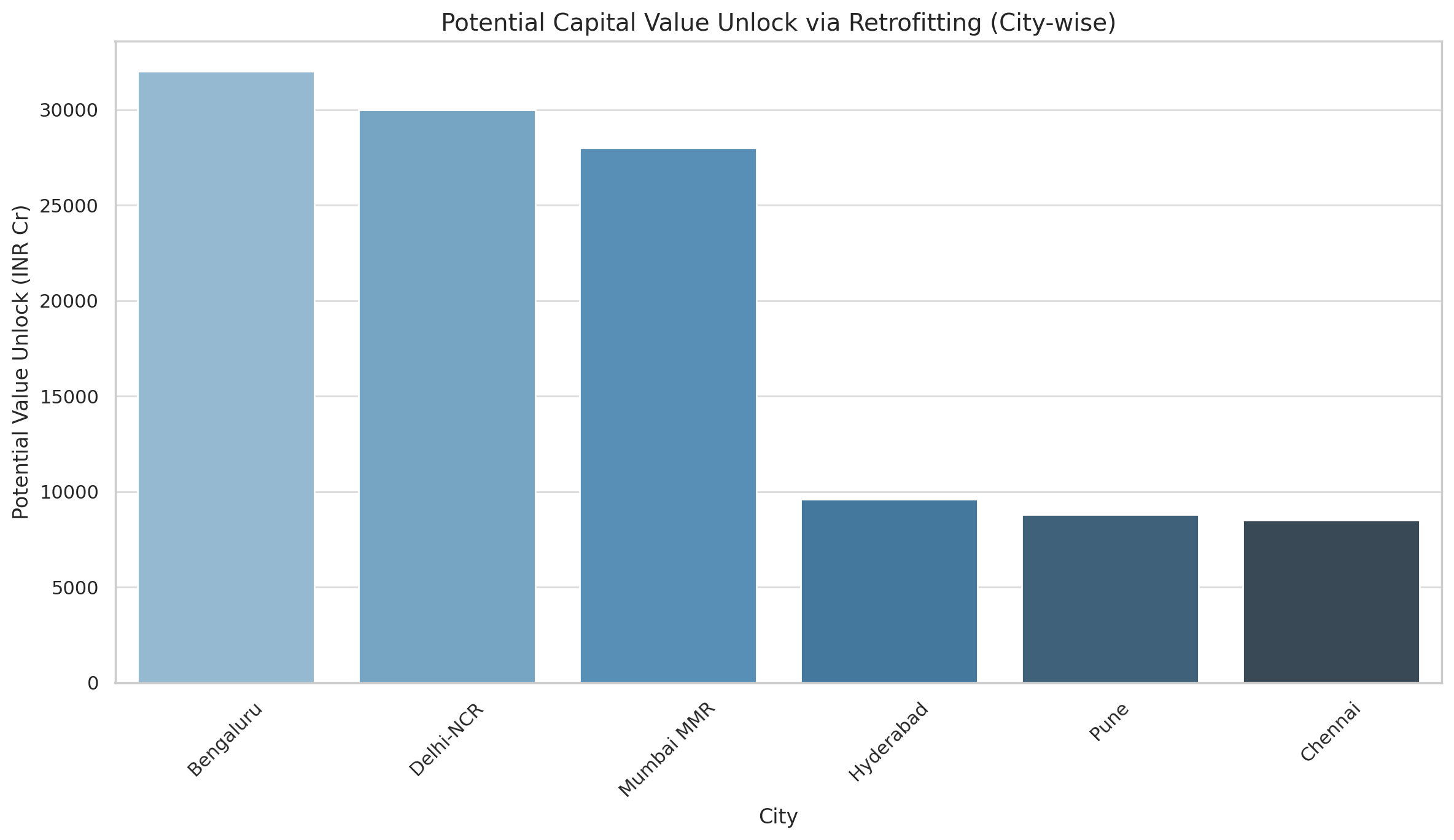

Bengaluru, NCR, and Mumbai lead retrofit demand

According to CBRE, over 160–180 million sq ft of India’s office inventory is more than a decade old and in need of varying levels of upgradation. Of this, more than 70% is concentrated in three major metros:

Bengaluru: 35–40 million sq ft

Delhi-NCR: 30–35 million sq ft

Mumbai (MMR): 25–30 million sq ft

These cities alone represent a retrofit investment opportunity of ₹20,000–25,000 crore, and could potentially unlock over ₹1 lakh crore in capital value post-upgradation. Bengaluru’s Outer Ring Road, Whitefield, and CBD/SBD areas lead the demand due to the presence of early-generation IT parks and SEZs.

In NCR, the focus is on Gurugram’s Udyog Vihar, Golf Course Extension, and Noida’s Sector 62/63 belt, where many buildings now face occupancy pressure due to lack of ESG compliance and modern infrastructure. Mumbai’s BKC, Andheri East, and Lower Parel also feature prominently in the list of zones with high retrofit potential.

Other cities like Hyderabad, Pune, and Chennai are expected to see 10–15 million sq ft of ageing stock each entering the retrofit cycle within the next 2–3 years.

“The retrofitting trend aligns with the maturing of India’s office sector, where older assets are under increasing pressure from Grade A+ supply and ESG-compliant buildings,” said Sumit Arora, head – National Operations & Workplace Strategy, CBRE Consulting.

Citing recent workplace experience surveys, CBRE notes that 81% of employees expressed a preference for upgraded workspaces offering better lighting, air quality, acoustic comfort, and breakout zones. More than 60% of respondents also stated that high-quality work environments have a direct impact on productivity and talent retention.

The report highlights a set of financial and operational value drivers propelling the retrofitting trend in India’s office market. Retrofitted buildings in high-demand micro-markets can witness capital appreciation of up to 40%, while commanding 15–35% higher lease rentals due to improved design, efficiency, and tenant experience.

Additionally, energy-efficient upgrades such as HVAC optimization, LED lighting, and advanced water systems can reduce operating costs by 20–30% over time. Beyond financial returns, retrofits also help developers and asset owners align with ESG benchmarks, achieve green certifications, and enhance the long-term sustainability profile of their portfolios.